The global mattress industry reached a valuation plateau of 30.3Bin2019,withpre−pandemicprojectionsanticipating6.244B by 2025. COVID-19 fundamentally disrupted this trajectory, creating a paradoxical landscape where sleep health prioritization collides with operational constraints. As consumer priorities and market dynamics evolve, we analyze four strategic differentiators redefining competitive advantage in the post-pandemic sleep economy.

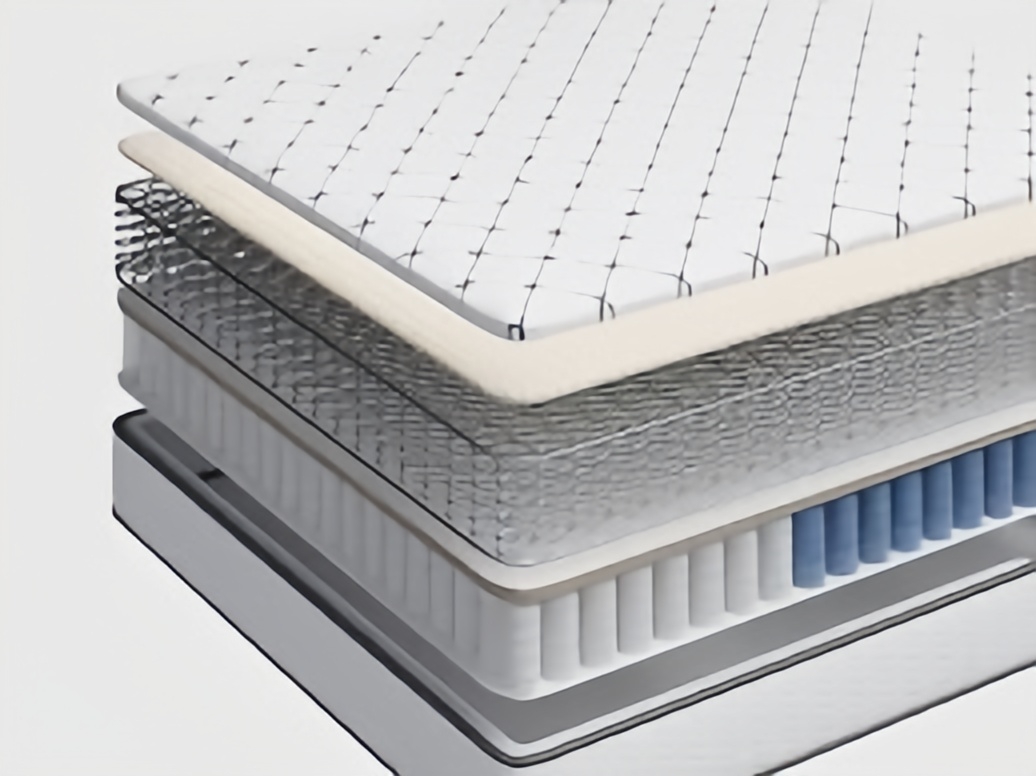

1. Hyper-Personalized Sleep Architecture

Beyond traditional luxury classifications, next-generation mattresses now incorporate biometric integration. Leaders like Bryte and Sleep Number report 23% revenue growth from AI-powered beds that automatically adjust firmness/flexure using real-time pressure mapping. The true innovation lies in layered customization:

- Modular foam cores with replaceable comfort layers (85% adoption rate among millennials)

- IoT-enabled climate control surfaces (+37% average order value)

- FDA-cleared sleep tracking integrations addressing medical reimbursement eligibility

2. Circular Commerce Models

The “bed-in-box” revolution has matured into sustainable closed-loop systems. Casper’s Re-Dream initiative (2024) achieves 92% material recovery through:

- Blockchain-tracked mattress recycling programs

- Carbon-negative shipping via electric vehicle fleets

- “Sleep as Service” subscriptions with bi-annual upgrades

3. Neuro-Marketing Integration

Progressive retailers leverage behavioral science through:

- VR sleep environment simulations (68% conversion lift)

- Somnographic data partnerships with wearables companies

- Gamified loyalty programs rewarding sleep consistency

4. Pharmacological Sleep Ecosystems

Strategic partnerships between mattress manufacturers and wellness brands create integrated solutions:

- Sealy x Calm app collaborations (1.2M bundled sales 2024)

- Tempur-Pedic melatonin-infused mattress covers (FDA Phase III trials)

- SleepScore Labs’ prescription-grade sleep improvement certifications